3 Factors to Check Before Buying an Investment Property in Australia

3 Factors to Check Before Buying an Investment Property in Australia

Before you jump into an investment purchase, run these three checks. They’ll help you avoid costly mistakes, choose the right suburb, and buy with confidence, whether you’re in Mandurah or investing interstate with the support of a buyer’s agent.

1. Finance & buffers (cashflow first)

Serviceability: confirm borrowing capacity (allow for rate rises).

True holding costs: interest, property management, insurance, maintenance, rates, strata.

Buffers: aim for 6–12 months of holding costs in offset/redraw.

Yield threshold: for most families, a gross yield ≥4.5–5.5% helps protect cashflow.

Pro tip: Talk to your broker about interest‑only vs P&I and model both scenarios.

2) Suburb selection (growth drivers)

Choose markets with population growth, tight vacancies, and diverse employment. Look for:

Vacancy rate: ideally <2% indicates strong rental demand.

Sales volume & days on market: stable volumes and reasonable DOM show depth.

Infrastructure: transport, health, new employments, education projects that improve liveability.

Value corridors: buy in the “well established" areas that are driven mostly by Owner Occupiers.

Pro tip: Work with a buyer’s agent who analyses national data and on-the-ground conditions, not just last year’s hotspots.

3) Property due diligence (asset quality)

Street & micro‑location: avoid busy roads, flood zones; favour quiet streets near amenities.

Build & layout: functional floorplan, good natural light, low‑maintenance construction.

Comparable sales & rent: verify price and achievable rent with 3–5 recent comparabiles.

Renovation upside: small value‑adds (paint, lighting, landscaping) beat major structural work for most investors. Even better if you by a property with little to no TLC required.

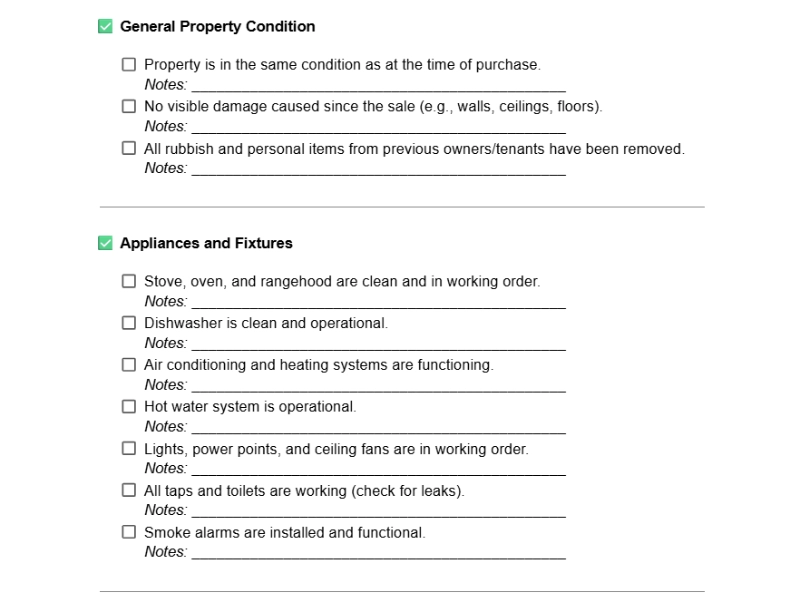

Pro tip: Your buyer’s agent should provide a due diligence checklist and negotiate based on comparable sales.

Common mistakes to avoid

Buying on emotion or headlines.

Overstretching cashflow without buffers.

Skipping inspections and strata due diligence.

Confusing “cheap” with “good value.”

How we help (The Rise Method™)

As a Mandurah based buyer’s agent working Australia‑wide, we follow a clear process, strategy, suburb shortlisting, sourcing (including on & off market), due diligence, and negotiation to help you buy the right asset, not just any asset.

Book a 15‑Minute Rise Assessment.